How Scarborough Mortgage Broker can Save You Time, Stress, and Money.

Wiki Article

Little Known Facts About Mortgage Broker.

Table of Contents10 Easy Facts About Mortgage Broker Scarborough DescribedSee This Report on Mortgage Broker Near MeMortgage Broker Near Me Can Be Fun For EveryoneHow Mortgage Broker In Scarborough can Save You Time, Stress, and Money.Getting My Mortgage Broker To WorkWhat Does Scarborough Mortgage Broker Mean?Little Known Questions About Scarborough Mortgage Broker.What Does Mortgage Broker Do?

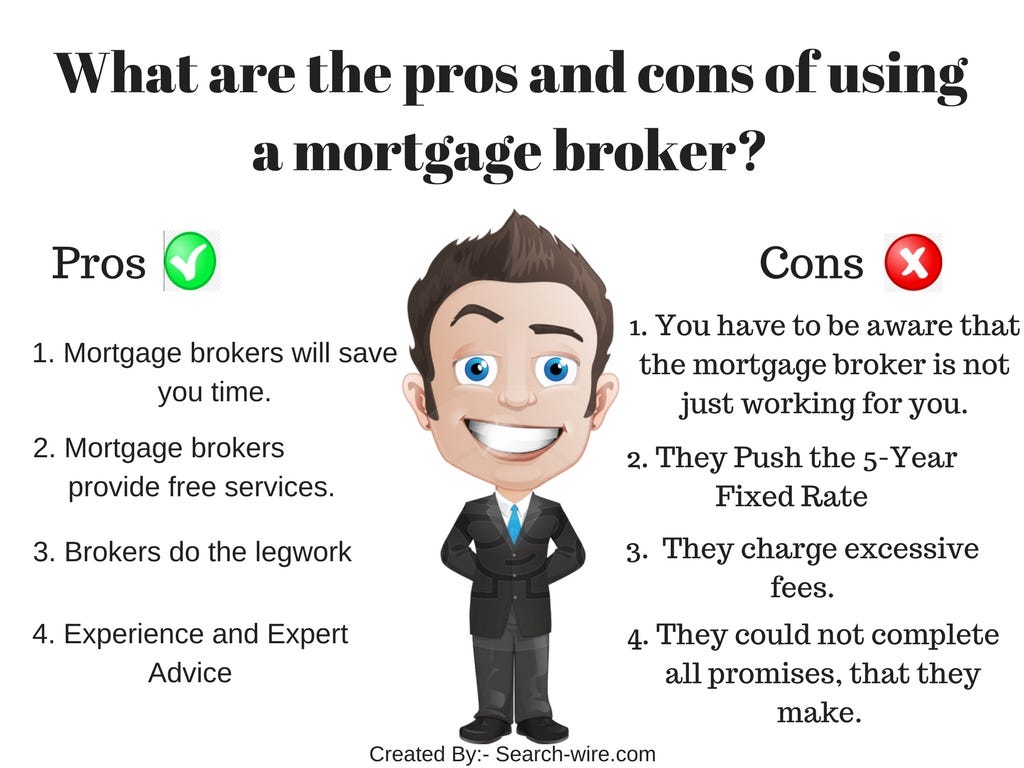

A broker can compare finances from a financial institution and a debt union, for example. A banker can not. Banker Income A home loan banker is paid by the institution, normally on an income, although some establishments provide economic incentives or perks for performance. According to , her very first obligation is to the establishment, to ensure finances are correctly protected and the borrower is entirely certified as well as will make the financing settlements.Broker Compensation A home mortgage broker stands for the borrower a lot more than the lending institution. His responsibility is to get the debtor the very best deal possible, regardless of the institution. He is typically paid by the car loan, a kind of payment, the difference between the price he obtains from the lending organization and also the rate he offers to the debtor.

Mortgage Broker Scarborough Things To Know Before You Get This

Jobs Defined Knowing the benefits and drawbacks of each could help you determine which job course you wish to take. According to, the primary distinction between the 2 is that the financial institution home loan policeman represents the products that the bank they function for offers, while a mortgage broker works with multiple loan providers as well as serves as a middleman between the lenders as well as client.On the other hand, bank brokers may find the job ordinary after a while considering that the process typically remains the same.

The Main Principles Of Mortgage Broker In Scarborough

What Is a Financing Officer? You may know that discovering a lending policeman is a crucial action in the process of acquiring your funding. Let's review what car loan policemans do, what understanding they need to do their job well, and whether financing police officers are the very best alternative for consumers in the loan application screening procedure.

Rumored Buzz on Mortgage Broker Near Me

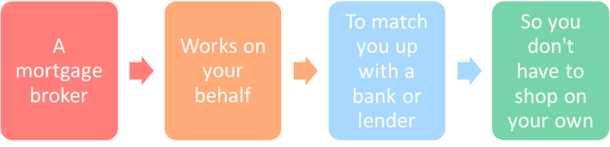

What a Lending Officer Does, A financing policeman helps a bank or independent lending institution to help consumers in obtaining a loan. Given that lots of customers deal with financing officers for mortgages, they are commonly described as home loan policemans, however numerous lending find officers help debtors with other loans also.

A financing officer will certainly consult with you as well as review your credit reliability. If a financing officer believes you're eligible, after that they'll recommend you for approval, as well as you'll have the ability to proceed on in the process of acquiring your loan. 2. What Lending Policemans Know, Finance police officers should have the ability to deal with consumers and small company owners, and they must have considerable expertise concerning the market.

Scarborough Mortgage Broker - The Facts

4. Just How Much a Loan Police Officer Costs, Some loan police officers are paid using payments. Home loan often tend to cause the biggest compensations as a result of the size as well as workload linked with the funding, however commissions are commonly a negotiable pre paid charge - mortgage broker near me. With all a car loan police officer can do for you, they have a tendency to be well worth the price.Loan policemans understand all regarding the lots of kinds of fundings a lending institution might provide, and also they can offer you guidance regarding the finest option for you and also your circumstance. Discuss your needs with your car loan officer.

A Biased View of Mortgage Broker Near Me

The Role of a Financing Officer in the Testing Refine, Your lending policeman is your straight contact when you're using for a financing. You will not have to worry about consistently getting in touch with all the people entailed in the home mortgage loan procedure, such as the underwriter, genuine estate representative, negotiation attorney and also others, due to the fact that your lending police officer will certainly be the factor of call for all of the entailed events.Because the process of a finance transaction can be a facility click site and also pricey one, many consumers favor to work with a human being as opposed to a computer. This is why banks may have several branches they wish to offer the prospective debtors in different locations who desire to satisfy face-to-face with a car loan policeman.

The Definitive Guide to Mortgage Broker

The Role of a Lending Police officer in the Car Loan Application Process, The home loan application procedure can really feel overwhelming, specifically for the new homebuyer. When you work with the best loan policeman, the procedure is really pretty basic.Throughout the loan processing phase, your funding police officer will certainly call you with any concerns the financing processors might have concerning your application. Your lending officer will certainly after that pass the application on to the expert, that will certainly assess your creditworthiness. If the underwriter authorizes your lending, your funding officer will then gather as well as prepare the appropriate funding shutting documents.

More About Mortgage Broker In Scarborough

more helpful hints

Report this wiki page